Paying off the mortgage early vs investing

As I sit and watch my portfolio drop by more than a grand (1.6%) due to Donald Trump's trade wars with China (and everybody else it seems) this is a question I find myself asking. Should I pay off my mortgage early or should I invest my savings in the hope of earning more in the long run? This is a question that causes a strong emotional feeling for people (including me) to think about due to the idea of home ownership and being mortgage free. I will try to explain my thought process and how I reached my conclusion to this complex topic.

Introduction

We live in strange times where interest rates have been at historic lows for several years now and the stock markets have also risen as a result of these low rates as companies can borrow money more cheaply they are able to make bigger profits, in the same way you and I have more money due to paying less interest on our mortgages. So should we use this spare cash to pay off our mortgage. First lets discuss the emotional aspects and then the risks.

Why emotions come in to this?

Everybody wants to feel secure in their own homes and many view a mortgage as an extra weight on their shoulders - another thing to worry about. These two things combine to make you feel compelled to pay your mortgage off. Everybody wants to say they are mortgage free and investments are risky so it's the obvious thing to do right? This compulsion combined with being risk averse makes sense until we think about it from a financial perspective.

What about Inflation?

Inflation is the factor that the emotions don't think about. Today U.K. inflation is at 2.4% my mortgage is fixed for 5 years at 1.79% this actually means the prices are going up faster than my mortgage debt meaning it should get easier to repay over time.

Inflation is good for borrowers and bad for lenders because it reduces the value of the money paid back to the lenders.

So the £750 I pay back each month actually costs me more now than it will in the future. £750 in five years time won't have as much value to me. This is due to inflation which at 2% would be equivalent to paying £680 a month in five years time.

As inflation makes your cash worth less over time you would currently need to earn at least 2.4% on your savings for it to keep it's current value in a years time. Cash under the mattress will become less valuable over time and even a 1% savings account is actually costing you 1.4% a year at present.

This is why people look for investments that will beat inflation. If you can earn a return that is above inflation then your money will grow in real terms over time. This growth compounds to create massive amounts of money over time. This is why you should pay in to a pension as early as possible to reap the biggest rewards. The same would hold true about getting on the housing ladder earlier in life rather than later as the house you want to buy will be more expensive in the future and you have longer to pay it off.

These exact same principals apply to pensions which become valuable when they beat inflation over time and why the earlier you start the more you will benefit.

What about the risks?

So with present rates of inflation being above our mortgage interest rate we are actually losing money in real terms if we pay off our house. We're also losing money by having it in a savings account earning 1%. This means our savings pot is going to become worth less over time whichever way you slice it.

The other problem with paying off your mortgage early is opportunity cost. This is the cost of missing out on an investment opportunity because your money is tied up in your house. By keeping your cash accessible you are able to take advantage of any opportunities that may come your way. There is a third factor to consider and that is the safety net. Say for example you put everything you have in to paying off your mortgage, what happens if your circumstances change and you want some of that money back? You may not be able to if your income has changed or you're no longer working. So instead of having a massive safety net like being able to pay the bills for the next ten years you could end up struggling to get by when the unexpected happens. The bottom line is like everything else in life it's a case of calculating the risk and reward and making an educated decision with the information you have at the time.

Investing

So if we can invest and earn an above inflation return on our money we can actually be better off. Lets use the FTSE 100 (the top 100 companies on the U.K. stock market) [1]. The average yearly return is around 5% including dividends when inflation is taken in to account we're getting 3% richer per year on average. When you compare it with you r mortgage rate of say 2% you can see how you can have your cake and eat it. The only thing you need is discipline not to spend it as it's easier to access which is a double edged sword. This is not without it's risks as we know but in the long term it's a sensible strategy should make you better off in the long run and puts you on the path to financial independence.

Some simple maths...

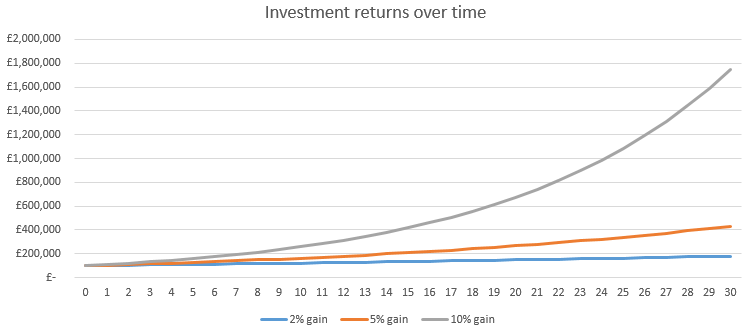

Here are some numbers to illustrate just how big the difference can be.

To make the maths easy I will use an "Interest Only" mortgage example in the real world you would have a repayment mortgage but this doesn't really alter the point it just makes the maths harder.

So a 30 year mortgage for £100,000 at 2% would cost £200 per year (£167 per month). Paying this off now and being mortgage free would save £60,000 in interest that would have been paid over the next 30 years.

Investing £100,000 now and averaging a 5% annual return rate after 30 years it would become £432,000. This is the magic of compounding.

After paying off your mortgage with £100k of the money and deducting the £60k interest charges you would be £272,000 better off than if you had paid your mortgage off on day 1.

It's also worth remembering that we have the freedom of selling some of our shares at any point to free up some money and take advantage of future opportunities.

I've dropped a table down below which shows the yearly figures to give you an appreciation compounding effect.

Conclusion

In the time it took me to write this article my portfolio has jumped to a new high gaining almost £2000 in a day (3%). In total I am up 25% (£15,000) over the past two years. Whilst my mortgage has been fixed at super low rates I've paid less than £2500 in interest on the equivalent borrowing over 2 years. The potential benefit of this approach over the long run is truly staggering, I am going to continue on my path of value investing and trying to ensure my returns beat my mortgage rate. It is difficult to annualise the current returns I have made because I've added heavily to many of my share holdings recently which skews the results. I may try to work on a way to calculate this later but for now, working backwords it approximates to a 12% per year gain. If I am able to continue this growth rate then I would approximately double my investment in six years. Over 30 years this would actually equate to a return of 30 times my investment amount meaning for every 10K invested would be worth 300K in 30 years time. This is how the rich get richer and another example how there's no better time to start than now.

Appendix:

Investment returns with £100,000 starting amount and no further investments.

Note that even a 2% gain returns £20k more than a 2% mortgage costs because mortgage interest doesn't compound as it gets paid each month.

| Year | 2% gain | 5% gain | 10% gain |

|---|---|---|---|

| 0 | £100,000 | £100,000 | £100,000 |

| 1 | £102,000 | £105,000 | £110,000 |

| 2 | £104,040 | £110,250 | £121,000 |

| 3 | £106,121 | £115,763 | £133,100 |

| 4 | £108,243 | £121,551 | £146,410 |

| 5 | £110,408 | £127,628 | £161,051 |

| 6 | £112,616 | £134,010 | £177,156 |

| 7 | £114,869 | £140,710 | £194,872 |

| 8 | £117,166 | £147,746 | £214,359 |

| 9 | £119,509 | £155,133 | £235,795 |

| 10 | £121,899 | £162,889 | £259,374 |

| 11 | £124,337 | £171,034 | £285,312 |

| 12 | £126,824 | £179,586 | £313,843 |

| 13 | £129,361 | £188,565 | £345,227 |

| 14 | £131,948 | £197,993 | £379,750 |

| 15 | £134,587 | £207,893 | £417,725 |

| 16 | £137,279 | £218,287 | £459,497 |

| 17 | £140,024 | £229,202 | £505,447 |

| 18 | £142,825 | £240,662 | £555,992 |

| 19 | £145,681 | £252,695 | £611,591 |

| 20 | £148,595 | £265,330 | £672,750 |

| 21 | £151,567 | £278,596 | £740,025 |

| 22 | £154,598 | £292,526 | £814,027 |

| 23 | £157,690 | £307,152 | £895,430 |

| 24 | £160,844 | £322,510 | £984,973 |

| 25 | £164,061 | £338,635 | £1,083,471 |

| 26 | £167,342 | £355,567 | £1,191,818 |

| 27 | £170,689 | £373,346 | £1,310,999 |

| 28 | £174,102 | £392,013 | £1,442,099 |

| 29 | £177,584 | £411,614 | £1,586,309 |

| 30 | £181,136 | £432,194 | £1,744,940 |

Difficult to find good data to present on historical FTSE returns the financial times shows the past year which has yeilded 7% https://markets.ft.com/data/indices/tearsheet/summary?s=TFTET100L:FSI ↩︎